There might be affiliate links on this page, which means we get a small commission of anything you buy. As an Amazon Associate we earn from qualifying purchases. Please do your own research before making any online purchase.

You probably have a lot of stuff laying around the house that you don’t need, right?

Take it from a guy that just made the move from Colorado to Tennessee, we all have things that we could get rid of.

But why do we accumulate so much stuff in the first place?

Well, it’s our natural tendency to want more.

We think having more will make us happier.

Whether it’s a new house, a faster car, nice clothes or a fancy handbag, many of us think that when we acquire more stuff everything in our lives will suddenly become hunky-dory.

In reality, the opposite is true.

That’s the hedonic treadmill in effect.

Have you ever bought a new car that makes you super happy on the day, but after awhile, the happiness fades?

And you want more?

This is the hedonic treadmill – the concept that people remain at a baseline level of happiness. Regardless of any external effects – like shopping – or changes in their life.

(Side note: One proven way to improve your happiness and life satisfaction is to focus on goals that truly matter. To get started, check out this FREE printable worksheet and a step-by-step process that will help you set effective SMART goals.).

Simply put, no matter how good or bad something makes you feel, you’ll eventually return to your original emotional state.

So major positive events in your life, like buying a new home, have very little influence on your long-term happiness.

The material possessions that you’ve desired and eventually purchase will lose their sparkle, and you’ll return to your happiness set point.

Buying stuff you don’t need is a major problem for a lot of people.

There is a reason Apple keeps coming out with new iPhones. It’s because we keep buying them!

I think right now they’re up to the iPhone 11. But do you really need it? Your iPhone 5 is perfectly capable of making calls, texting, surfing the web and taking pictures.

But we think having an iPhone 11 will make us happy. So we buy it!

And guess what? The shiny new phone doesn’t make us any happier. And in a few months, we’re going to want the iPhone 12.

So if buying more stuff doesn’t make us any happier, how do we stop buying stuff we don’t need?

Seems like a simple fix. Just stop buying stuff you don’t need, right?

But it’s not that easy.

Many of us are addicted to shopping. And some of us can’t seem to get off the hedonic treadmill.

7 Ways to Stop Buying Stuff You Don’t Need

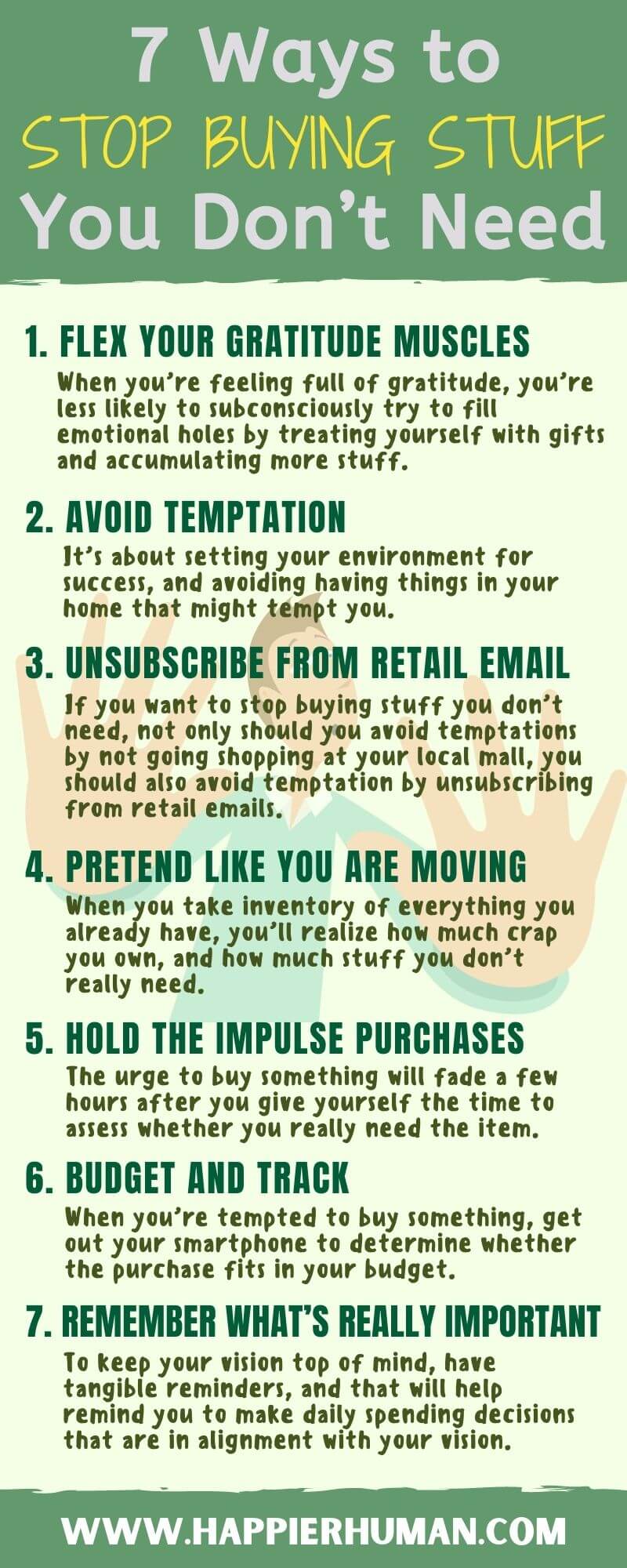

1. Flex Your Gratitude Muscles

You might be aware of the benefits of gratitude.

When you appreciate everything you DO have, you tend to not want more “stuff.” You realize that the important things in life are things like experiences, family, deeper relationships, and the small things in life that we often take for granted – sunny days, tall trees, and that delicious cup of coffee.

Practice gratitude for everything you have in your life – experiences, opportunities, your health, the beauty all around you and the good people in your life – and you’ll realize you’re already living a “rich” life.

When you have an attitude of gratitude, it creates a feeling of abundance within you.

When you’re feeling full of gratitude, you’re less likely to subconsciously try to fill emotional holes by treating yourself with gifts and accumulating more stuff.

And next time you want to buy something you don’t really need, just keep this simple phrase in mind: “you already have enough.”

2. Avoid Temptation

This one makes practical sense, and I’ve talked a lot about avoiding temptation with my clients from my days as a fitness coach.

If you’re trying to lose weight, you don’t want to stock your home with ice-cream, candy and chips, right. It’s about setting your environment for success, and avoiding having things in your home that might tempt you.

Similarly, If you have a tendency to splurge on things you don’t need, then don’t go to the mall to window shop. If you’re thinking about buying that iPhone 11, don’t go to the Apple store. Set yourself up for success and avoid temptation.

Some people say they love to shop, or they describe it as “retail therapy.” If this is the way you view shopping, find other things to do that are fun and will help you unwind, such as a walk in nature or game night with friends.

3. Unsubscribe from Retail Emails

You probably get bombarded by emails every single day.

Whether they’re work emails, joke of the day emails, spam emails, or any of a number of email lists you’ve subscribed to, most of us have a very cluttered email inbox. In fact, each day, the average office worker receives 121 emails. That’s 44,165 emails per year. And many of these are retail emails. From retail stores. Looking for your money by sending you irresistible offers for things you don’t need.

If you want to stop buying stuff you don’t need, not only should you avoid temptations by not going shopping at your local mall, you should also avoid temptation by unsubscribing from retail emails.

We probably get weekly (or sometimes daily) emails advertising the latest discounts at our favorite stores and travel destinations. If you keep getting these discount emails, eventually you’ll cave in and shop. Unsubscribe from those emails. Not only will you not be tempted, your email inbox will be less cluttered.

4. Pretend Like You Are Moving

One of my business coaches gave me this tip to be more productive – pretend like you’re going on vacation.

Have you ever noticed how productive you are the day before you go away for a week or two? The thought of a distraction-free vacation is a motivator to get things done in a timely manner.

You can use a similar thought process when you’re tempted to buy more stuff. Pretend like your moving!

When you’re getting ready to move, you have to take inventory of everything that you already have, right? Believe me, as someone that seems to move to a new apartment practically every year, going through everything you already own is a pain.

But it’s eye opening!

When you take inventory of everything you already have, you’ll realize how much crap you own, and how much stuff you don’t really need. And if you’re like me, you probably will have a lot of stuff you can donate.

Like bags of clothes and boxes of books, and some household goods.

When you have a lot of stuff, it’s hard to tell how much you really have. So pause, take an assessment, and make a list of everything you own. This will help you realize how much you already have, and help you stop buying stuff that you don’t need.

5. Hold the Impulse Purchases

Impulse buying. We’ve all done it! We make a list of things we absolutely need, are laser focused on sticking to the list, and then BAM!

We see a shiny new object that we have to have! There’s an appeal and temptation to buy what’s new and trendy.

The next time this happens to you, what if you pause and wait?

As a fitness coach, I use this same trick with people wanting to lose weight. We all probably have cravings, right? Mine is chocolate…any chocolate. Instead of giving into the craving, I’ll coach clients to pause and wait at least 15 minutes, and then see if they still have the craving. If their cravings are strong, they might need to take another action, like drinking a glass of water, going outside for a walk, or even calling a friend.

Most of the time, the craving and urge to eat junk food goes away.

The same can be said for impulse purchases. Next time you have the impulse to purchase that shiny new thing, stop. Wait for at least 24 hours. You might be surprised, but most of the time, the urge to buy will fade after a few hours when you give yourself the time and space to assess whether you really need the item.

6. Budget and Track

I’m going to continue with the fitness theme here. One of the best ways to reach a weight loss goal is to track your eating, take measurements and have accountability. There are apps like My Fitness Pal where you can log everything you eat. So you know whether you’ve eaten 2000 calories for the day, or 5000. You can take it one step further and have a fitness coach review your logs to see how you’re doing. It’s the ultimate way to stay accountable and not overeat.

Or how about this – what if you always had a scale with you, and everytime you were thinking about drinking a glass of wine or indulging in an ice-cream cone, you took the scale out to weigh yourself to see how close you were to your weight loss goal? I bet if you did this, it would be easier to say no to that treat. The scale would keep you accountable.

Same thing goes for your spending. Create a budget, and then download an app on your phone to help you track your spending.

When you’re tempted to buy something, get out your smartphone to determine whether the purchase fits in your budget. If it doesn’t, all bets are off; don’t make the purchase.

If you don’t want to use an app, consider using Dave Ramsey’s Envelope System. The envelope system is based on the psychology that people spend less when using cash than credit or debit cards. All you need are a few envelopes. Here’s how it works: Let’s start with your salary. Assume you get paid twice a month with a total take-home income of $3,000 during that period.

Then you budget $500 a month for groceries, or $250 per paycheck. When the month’s first paycheck is deposited, go to the bank and withdraw $250. Put that cash in an envelope and label it “Groceries.’’

Every time you purchase “groceries” it must be with money from that envelope and only that envelope. If your bill comes to $260, you must put something back.

Once the money is gone from your “Groceries” envelope, you’re done until the next paycheck arrives. When you get your second paycheck of the month, withdraw another $250 and refill the “Groceries” envelope.

Make envelopes for all of your discretionary spending such as groceries, restaurants, entertainment, personal, gifts, health, haircare, makeup, clothing, etc.

It takes discipline, but try it out! It’s a great system to see how good you are at budgeting and staying within your budget.

Most of us have a vision of what’s really important in our life and what we want our life to look like. And setting goals is essential for achieving your vision.

7. Remember What’s Really Important

Suppose you want to travel to a 3rd world country and volunteer. That’s a great goal to strive for, but for many of us, we lose sight of our goals and we do things out of alignment with what we really want.

Is buying the latest iPad or a fancy dress going to help you get closer to your goal of traveling and volunteering? You need to make financial decisions in the day-to-day that are in alignment with the big picture vision of the life you want.

If our goals only exist in our head, it’s easy to lose sight of them. To keep your vision top of mind, have tangible reminders, and that will help remind you to make daily spending decisions that are in alignment with your vision.

For example, an image of the country you want to travel to and the people you want to volunteer to help can be on your computer background and act as a reminder to save and spend your money wisely. Find what works for you in terms of writing down your goals and being able to see them everyday.

You now have 7 ways to stop buying stuff you don’t need. This doesn’t mean you have to be perfect and never splurge on something you want. Rather, these strategies are designed to help you make spending choices consciously more mindfully, so you feel good about your purchases.

Finally, one proven way to improve your happiness and life satisfaction is to focus on goals that truly matter. To get started, check out this FREE printable worksheet and a step-by-step process that will help you set effective SMART goals.

Scott Colby is an adventure lover who has always created businesses around his passions. Although he has spent over a decade in the fitness industry, helping people create transformations, it was a trip to Guatemala that inspired him to create his latest brand – Say It With Gratitude.